High-Income Real Estate Buying New York: Optimizing Your Returns

Buying property is a reliable approach for constructing riches, and for those aiming to take it to the following degree, high-income real estate investing in New york city offers an amazing chance. New York, with its dynamic economy, global standing, and varied property market, offers numerous methods for financiers to produce substantial income. From the dynamic city of New York City to the growing chances in Upstate New York, high-income property financial investments can provide outstanding returns when approached purposefully.

In this short article, we'll explore the vital techniques, markets, and building kinds that can assist you do well in high-income realty investing in New york city.

Why Purchase New York Property?

New york city has long been a magnet genuine estate financiers because of its diverse economic situation, high demand for rental residential or commercial properties, and possibility for considerable admiration. Key factors to consider high-income property investments in New york city include:

Strong rental market: With a big populace, high demand for real estate, and limited room in several metropolitan locations, rental homes in New york city are often in short supply, increasing rental rates.

High gratitude possibility: Residential or commercial property worths in New york city, particularly in the five boroughs of New york city City, often tend to value in time, developing long-term riches for capitalists.

Varied market options: From high-end apartments in Manhattan to commercial real estate in Upstate New York, the state uses a wide variety of investment chances, permitting capitalists to diversify their portfolios.

Ideal Markets for High-Income Property in New York City

New york city supplies a series of profitable realty markets. A few of the most effective areas for high-income real estate investing consist of:

1. New York City City

New York City is one of the most competitive and rewarding property markets worldwide. Capitalists can maximize:

Deluxe rentals: Manhattan, in particular, is home to high-end homes and apartments that draw in affluent renters ready to pay premium rents.

Multifamily homes: The city's high population density and continuous demand for housing make multifamily properties (such as apartment buildings) a reliable source of income. Districts like Brooklyn and Queens supply exceptional chances for multifamily investments, frequently with lower procurement prices than Manhattan.

Industrial realty: NYC's successful business districts produce sufficient opportunities for industrial real estate investments. Office spaces, retail buildings, and mixed-use growths can produce strong cash flow due to long-term leases and high need.

2. Upstate New York

While New York City is understood for its sky-high rates, Upstate New york city presents a extra cost effective choice for investors looking for high-income opportunities. Cities like Albany, Syracuse, and Buffalo are experiencing revitalization, with growth in populace, work chances, and realty demand. Secret opportunities consist of:

Value-add buildings: In cities like Albany and Buffalo, financiers can find value-add buildings-- older homes or buildings that can be restored and enhanced to raise value. These buildings are normally more budget friendly than in New York City, yet they still provide substantial returns after improvements.

Holiday rentals: In areas like Saratoga Springs, Lake George, and the Finger Lakes, temporary and vacation leasings remain in high demand throughout peak periods, providing financiers with possibilities to earn greater rental revenue through platforms like Airbnb.

Approaches for High-Income Real Estate Purchasing New York City

1. Concentrate On Multifamily Characteristics

Buying multifamily residential properties is one of the most efficient means to create high income from realty. In New York, multifamily residential properties are specifically attractive due to the demand for housing in both metropolitan and suburbs. With several tenants paying rent, these residential or commercial properties use several streams of revenue, and the threat of openings is decreased because even if one unit is uninhabited, others are still producing income.

In neighborhoods throughout Brooklyn and Queens, multifamily properties remain to appreciate as need for housing expands, making them a solid choice for capitalists.

2. Check Out Short-Term Rentals in Visitor Areas

Temporary leasings, especially with platforms like Airbnb and VRBO, can yield dramatically higher earnings than lasting rentals, particularly in high-demand vacationer areas of New York. Properties in destinations such as Saratoga Springs, the Hamptons, and Niagara Falls are exceptional candidates for short-term rentals, as they draw in site visitors throughout the year.

When buying temporary leasings, consider the following:

Place: Select residential properties near major destinations, occasions, and facilities to ensure consistent reservations.

Monitoring: Temporary rentals require more hands-on administration, so hiring a residential property monitoring firm can aid simplify procedures and make certain a positive guest experience.

3. Purchase Business Property

For capitalists seeking high-income chances, industrial property can be extremely profitable. Office spaces, retail homes, and commercial structures in locations with economic growth can create considerable rental income because of long-lasting leases and greater rent rates. New York City's business property market supplies a few of the greatest rental yields in the nation, however smaller cities in Upstate New york city, like Albany and Rochester, additionally present strong chances for business financial investment.

4. Use Leverage Intelligently

Leverage, or making use of obtained funding to fund your real estate investment, is a powerful device in high-income realty investing. In New York, where property costs can be high, making use of a mortgage can enable investors to buy residential properties that might or else be out of reach. Nonetheless, it's essential to ensure that the rental earnings covers the home mortgage and other expenditures, offering positive capital.

By utilizing take advantage of tactically, you can maximize your return on investment and increase your portfolio's earning possibility without locking up every one of your funding in one home.

5. Think About Luxury and High-End Feature

Deluxe buildings in areas like Manhattan and the Hamptons typically command top dollar in both rental and resale worth. High-net-worth individuals want to pay premium rates for deluxe homes, condos, and houses, making this industry among one of the most lucrative in real estate.

High-end buildings frequently value much faster than various https://sites.google.com/view/real-estate-develop-investment/ other sectors, and because they satisfy wealthy tenants, they can regulate a lot greater rent prices. Financiers in this market need to concentrate on supplying premium amenities, such as modern coatings, attendant services, and prime areas, to bring in affluent tenants.

High-income real estate investing in New york city supplies extraordinary opportunities for capitalists wanting to take full advantage of returns. Whether you're targeting high-end rentals in Manhattan, multifamily residential or commercial properties in Brooklyn, or temporary trip leasings in Upstate New york city, there are approaches to match various budgets and goals. By focusing on prime locations, leveraging the right chances, and carrying out efficient management strategies, you can turn your New york city property investment right into a reliable source of high earnings.

Buying New York's growing and varied property market can lead to long-term wealth and financial success. With the best method and market https://sites.google.com/view/real-estate-develop-investment/ expertise, you can unlock the complete potential of high-income real estate investing in the Empire State.

Mara Wilson Then & Now!

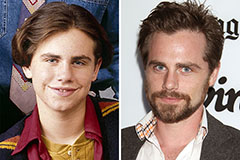

Mara Wilson Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!